Buyer Behavior- Why Rent When You Don’t Have To?

At Nations Lending we see first-hand how clients change over the years. There are shifts in financial demographics: credit score, income and median housing prices. But more importantly there are shifts in homebuyer behavior: an increase in the average age of a homeowner and increase in the length a person rents before buying.

According to Zillow, across the country’s largest markets, nearly 14% of on-market renters have:

-

Strong Credit Scores

-

Relatively high incomes

-

Ability to buy median homes in their market

However, U.S Census Bureau states that the homeownership rate is steadily declining across the US. If this wasn’t enough, housing markets that have lower homeownership rates tend to have more financially qualified renters. So, this begs the question:

Why are more people renting when they don’t have to?

Nations Lending sees this first hand in a number of areas that we lend. In some markets, especially those which are technology-heavy, people are renting until they decide if they want to permanently settle in that area. Our mortgage advisors are also noticing that people are marrying later in life as well as starting familiars later, which are two reasons that typically accompany homeownership. With a shift in these buyer behaviors it’s important to always stay on top of understanding your market.

Nations Lending sees this first hand in a number of areas that we lend. In some markets, especially those which are technology-heavy, people are renting until they decide if they want to permanently settle in that area. Our mortgage advisors are also noticing that people are marrying later in life as well as starting familiars later, which are two reasons that typically accompany homeownership. With a shift in these buyer behaviors it’s important to always stay on top of understanding your market.

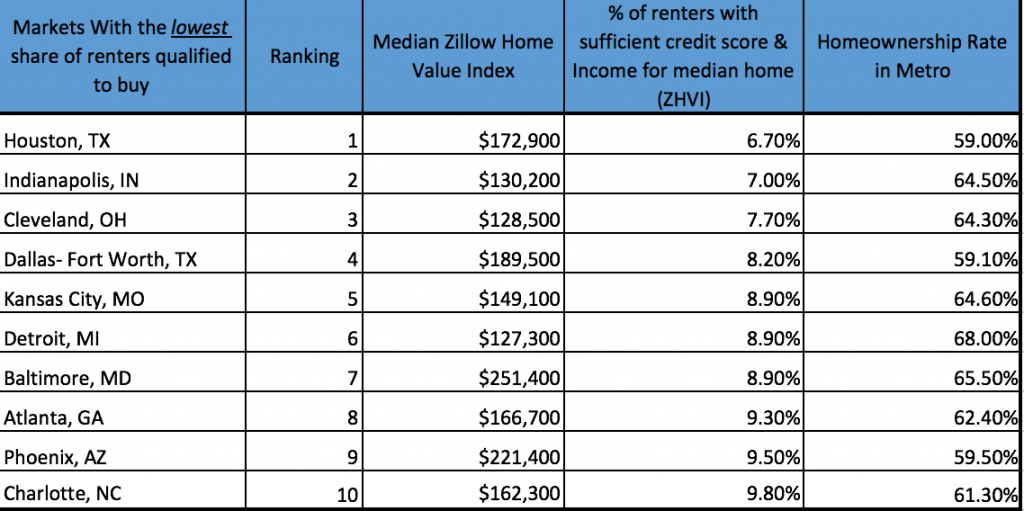

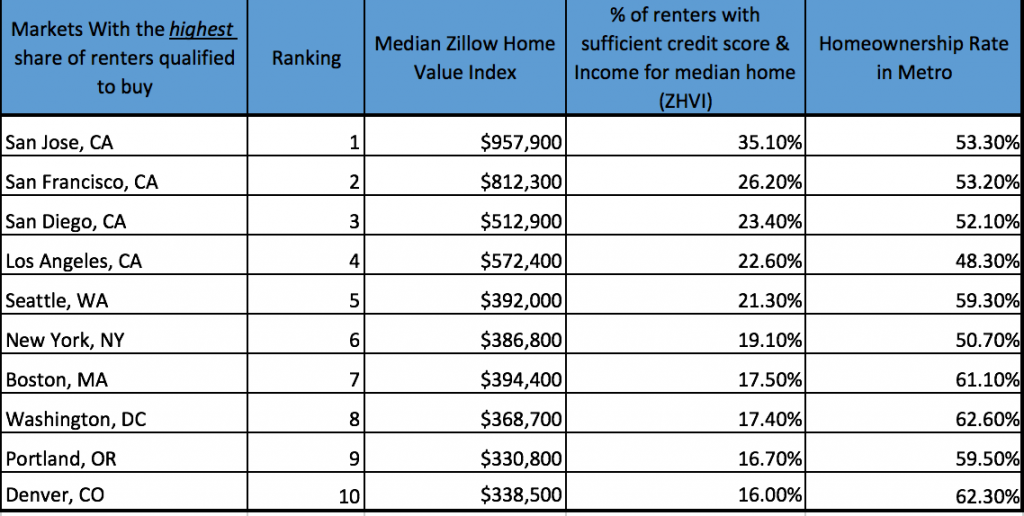

If we look back at the previous Zillow Study in which they looked at the self-reported credit scores and incomes of renters to see which large housing markets have the most qualified renters. They grouped the credit scores into strong/ weak (strong above 700) and income into higher/lower based on being greater than or equal to the monthly income necessary to afford a typical rental in the given area.

It seems that San Jose is the only large market analyzed where the share of on-market renters with strong credit and high incomes exceeds the share of on-market renters with weak credit and low-incomes. The markets in which stronger credit scores and higher income was furthest away from weaker and lower? Houston, TX and Indianapolis, IN.

No Comments