Interest Rates- Steady as She Goes

Last week we discussed what in the economy is currently moving interest rates and we continue that discussion this week. The job market here in the United States, as Nations Lending’s originators know, indicates that our economy is doing well. Now, normally a fast-paced economy typically leads to higher interest rates. But if only life was that simple!

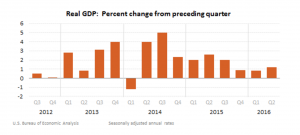

On the other side of the balance sheet, we had a dismal Q2 real GDP (Gross Domestic Product – a reading of the overall health of an economy) reading. Yet the momentum of the economy is carried by the July Nonfarm Payrolls rising by 275,000 in July, and the August number, also a decent increase announced last week, with the unemployment rate unchanged at 4.9%.

But Nations’ mortgage advisors and branch managers know that employment is not the only gauge of economic health. The ISM (Institute of Supply Management) Manufacturing Index came in a bit lower than expectations but still “suggests steady gains in the factory sector.” The Federal Reserve Open Market Committee has consistently said that it needs to see a stronger labor market before the Fed Governors vote for a rate hike. If the recent momentum is sustained the “probability of at least one rate hike this year becomes more believable.” But since the 2Q GDP only rose by 1.2% this puts the chance of a rate hike by the end of the year at less than 50%.

But Nations’ mortgage advisors and branch managers know that employment is not the only gauge of economic health. The ISM (Institute of Supply Management) Manufacturing Index came in a bit lower than expectations but still “suggests steady gains in the factory sector.” The Federal Reserve Open Market Committee has consistently said that it needs to see a stronger labor market before the Fed Governors vote for a rate hike. If the recent momentum is sustained the “probability of at least one rate hike this year becomes more believable.” But since the 2Q GDP only rose by 1.2% this puts the chance of a rate hike by the end of the year at less than 50%.

One area of negativity was that of construction spending. There were hopes of a strong June release as construction could have provided a boost to the lower-than-expected 2Q real GDP print. Unfortunately, the report was poor, with the total nominal value of construction spending put-in-place unexpectedly falling during the month, marking the third straight month of weak readings. And a positive is that retail sales went up 0.6% in June and they expect it to climb 0.4% in July.

The recent advance estimate of second quarter GDP had consumer spending rising 4.2 percent—the strongest since the fourth quarter of 2014. This is big since consumer spending is going to play a pivotal role in the U.S. economy going forward. Recent numbers suggest that, for now, it could be “steady as she goes” for rates.

No Comments