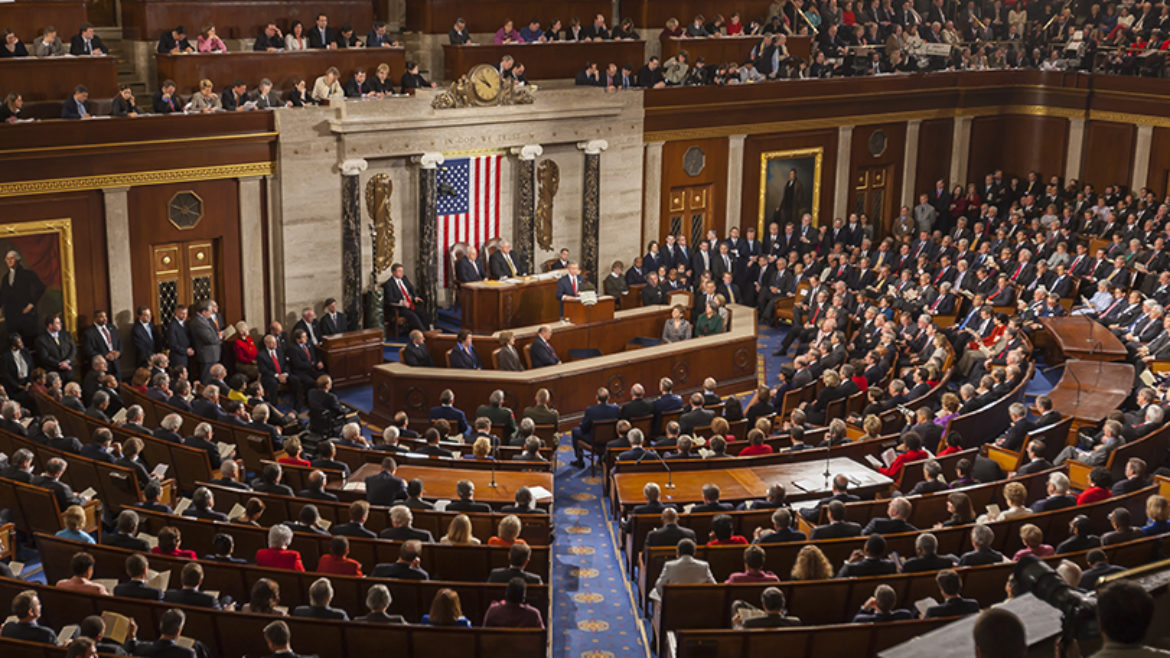

Affordable Care Act, Individual Tax Policy & Corporate Tax Rates: What’s next?

Since President Donald Trump has been sworn into office he and Congress have begun to tackle their fiscal policy agenda. Here at Nations Lending, we think it’s important for clients to understand these policy changes and how it may impact the economy. Common policy changes may include: increase in defense spending, the repeal of the Affordable Care Act and related taxes, Dodd-Frank rumblings, and individual income tax & corporate tax cuts.

Here is an overview of the possible changes we can expect:

Affordable Care Act (Obamacare):

- Revenue neutral and not significantly impacting the budget currently

- Long-term impact up to $150 billion over 10 years but still undecided

Individual Tax Policy:

- The elimination of the alternative minimum tax, along with estate and gift taxes

- 7 tax brackets to get cut down to 3

- Capital gains and dividend tax rates will be reduced

- Expected total fiscal effect on the federal government of $164 billion in calendar year 2018

Corporate Tax Cuts:

- Expected after-tax corporate profits to rise 3.2 percent in 2018

- Cuts most likely won’t be implemented until 2018 so there will be a “negligible effect in 2017

- Total fiscal effect beginning 2018 will amount to roughly $230 billion in additional deficit spending and a similar increase in net Treasury issuance

- Impact on real GDP will take place in 2018 with an increase in the expected forecast by 0.2%

What does all this mean for rates? To be frank, perhaps not much. This thinking is already incorporated in current mortgage rates, although predicting the future is never a 100% certainty. Nations Lending continues to offer excellent rates and a wide product range for our clients – call for information!