Changes in Home Loans over the Years

Here at Nations Lending we have a mix of experienced mortgage advisors as well as newly minted advisors to help clients. No matter the experience, there is no doubting that there is consistently changes to the mortgage industry. To show the major trends and changes, Zillow conducted a Study that analyzed data on millions of conventional, conforming mortgages that were acquired by Fannie Mae between 2000 and Q1 in 2015. Within this study, they identified key trends among borrowers and focused on loan value, down payments, creditworthiness and property type.

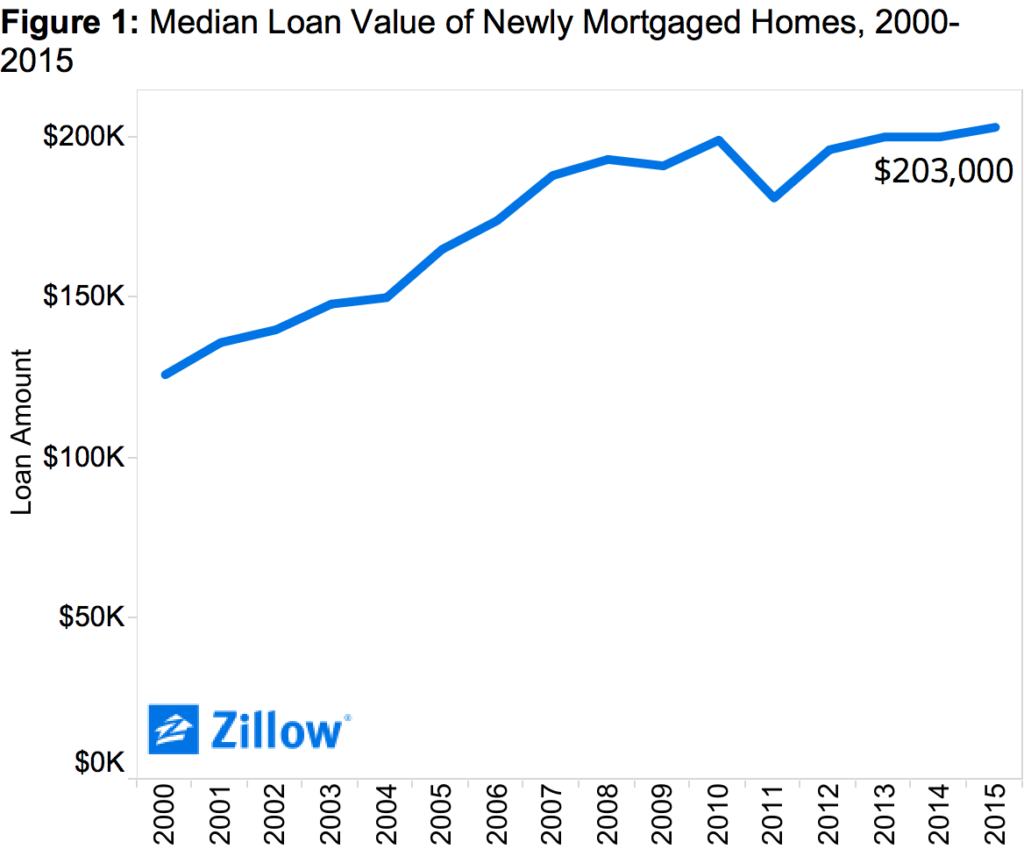

Loan Value: As home prices rose from the housing bubble, buyers were forced to take out larger loans. Between 2000 and 2008, the median conventional loan value climbed from $126,000 to $193,000, a 53 percent increase. After the housing market recovered there was an end to the dramatic increase in home values. Between 2008 and 2015, the median loan amount grew by only 5.2 percent to its current value of $203,000.

Down Payments: The analysis revealed that while some aspects of conventional mortgages have returned to pre-recession patterns, for others a new normal has emerged. We often tell clients that a 20 percent down payment is seen as the standard for conventional loans. Prior to the 2008 recession, less than one-third of buyers actually opted for 20 percent down. In recent years however, a 5 percent down payment is becoming just as popular and making it’s way to becoming a norm.

Creditworthiness: By 2010, high-credit buyers accounted for an astonishing 84% of new mortgages purchased by Fannie Mar. This is up from barely half in 2000. Since t hen, moderate credit borrowers have regained some market share as lending has eased. However, conventional loans to those with scores below 640 have all but disappeared.

hen, moderate credit borrowers have regained some market share as lending has eased. However, conventional loans to those with scores below 640 have all but disappeared.

Property Type: The share of conventional loans used to finance single-family home purchases has been steadily declining; from more than 80 percent in 2000 to 57 percent in 2015. Supplanting single-family home and condominium purchases in many parts of the nation. Further, the share of investment properties that are single-family homes has been declining at a slower rate than the share of primary and secondary residences- even ticking up marginally in 2013 and 2014. This rising change shows no signs of reversing soon.

With these consistent market changes, Nations Lending finds it extremely important to stay on top of the trends. We ensure that our program suite has something that helps borrowers with many of these situations!