The Presidential Election, Interest Rates, and Mortgages: What Does It Mean?

Donald Trump won the US Presidential Election and interest rates immediately shot up. Why? Although mortgage rates have been gradually moving higher since September, just after two post-election trading days, we find mortgage rates right where they were in February early this year.

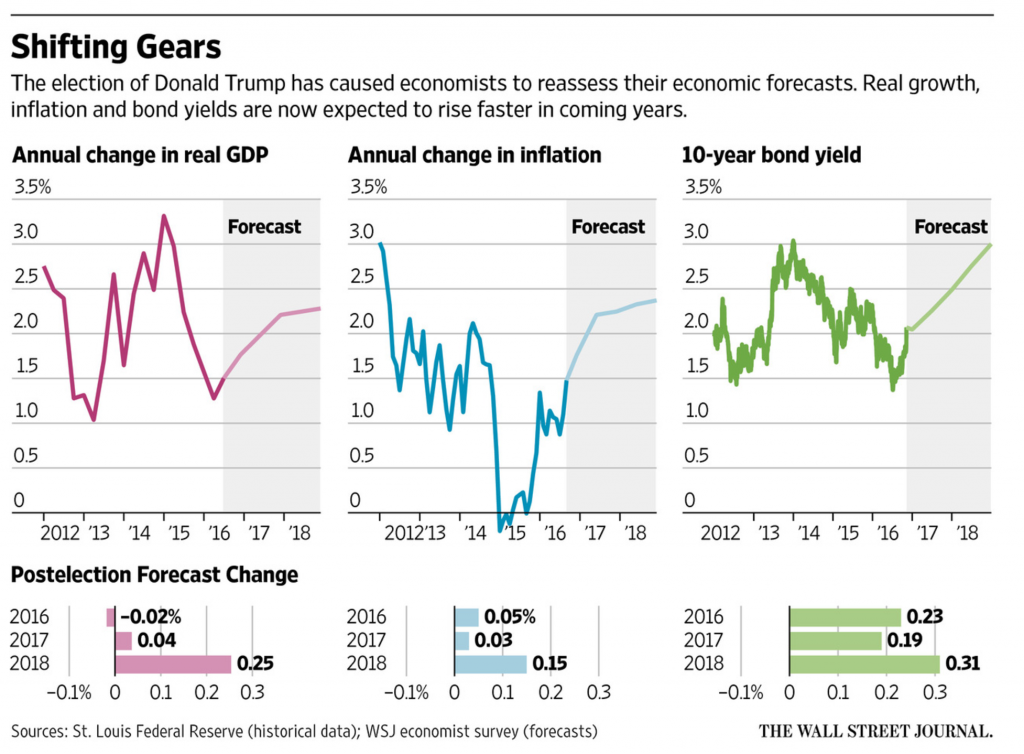

Trump won’t officially become President until January 20th 2017 but we are still staying ahead and answering questions regarding moving rates. Markets (and people) don’t like uncertainty and where we are now with the Presidential elect is most definitely uncertainty to the people. Right now the stock and bond markets are trading off Mr. Trump’s previously stated economic policy proposals. Investors feel the new administration will be more business friendly with tax cuts, deregulation, and higher defense spending. However, bonds are selling off (moving interest rates higher) because President-elect Trump has promised to impose tariffs and deliver a $1 trillion infrastructure spending package; both of which could increase the Federal deficit, ultimately driving up inflation.

Inflation can be defined as “the riding prices of goods and services over time”. Rising prices erode the purchasing power of a bond’s fixed future interest payment. It is still expected that the Federal Reserve’s Open Market Committee will increase short-term rates in December this year. The interest rate movement that has occurred since the election represents the market’s belief that President-elect Trump’s policies will result in inflation. This is including the $1 trillion infrastructure spending bill which brings about two important questions:

-

Where will workers come from? With our low unemployment rate will there be difficulty finding qualified workers.

-

Where will the money come from for infrastructure changes? This includes the money to pay for the road and bridge work as well as wages. Employers must pay higher wages in order to attract skilled workers which could ultimately lead to more inflation

Employers must pay higher wages in order to attract skilled workers which could ultimately lead to more inflation.

Right now the markets tell us that traders saw nothing but the prospect for inflation and interest rates on Treasuries as they begin to rise. It’s worth noting that usually an unexpected event causes a “flight to safety” of government debt, pushing yields down. The fact that the opposite occurred reflects fears that the deficit might balloon and inflation could become rampant. Until early January 2017, rumor and uncertainty will rule the markets.

It’s important to keep things in perspective! The average interest rate on a 30-year loan over the past 38 years was approximately 7%. Today’s 30-year rates are in the high 3’s. They are still very good so make sure to check with your Nations Lending office about current rates.

No Comments